Big Picture: Bias is Bearish, Market Has Broken The Upward Channel Support From October 2023 Low, $VIX Below 20 (complacency)

Today´s Pivot is 5698

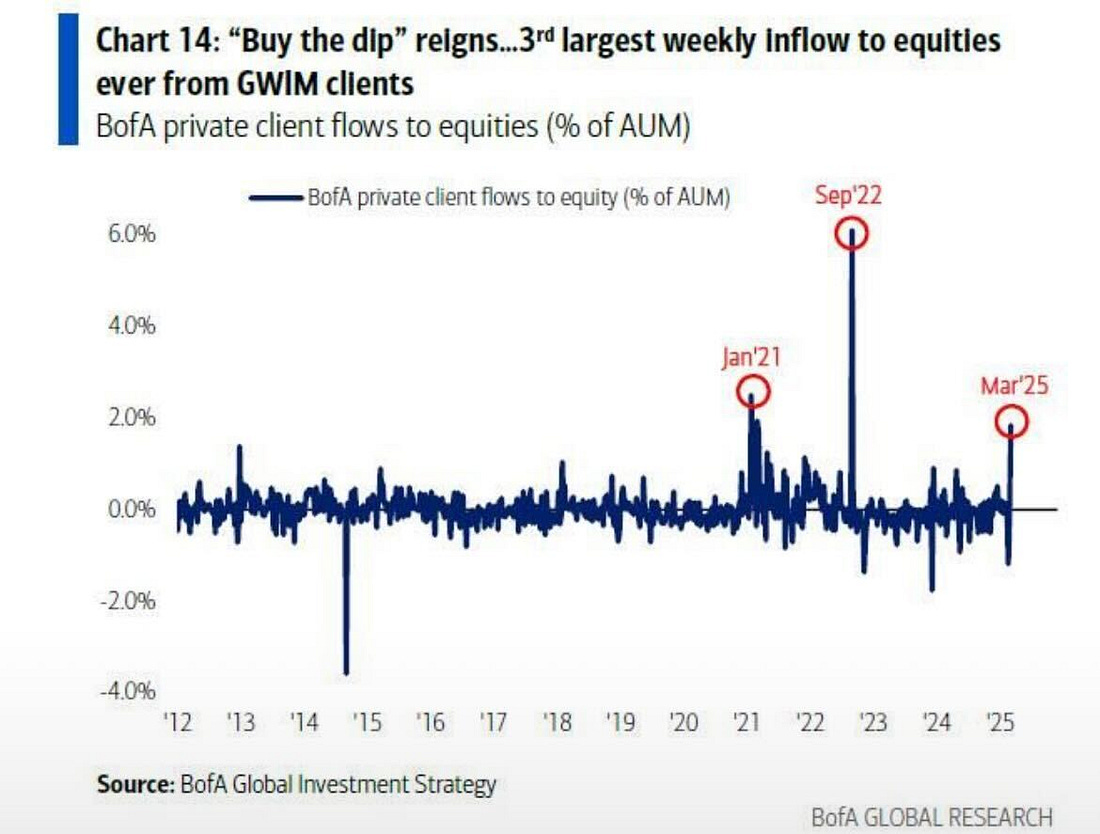

In the Sunday Post analysis, it was observed that US stock indexes and multiple sectors showed signs of consolidation, suggesting a potential stabilization after several weeks of declines. Historically, seasonality trends indicate that markets tend to form a bottom around mid-March, but it's still too early to confirm whether this pattern will hold. Notably, a week ago saw a significant surge in equity inflows, as investors took advantage of lower prices to "buy the dip." The chart below highlights this trend, showing the third-largest weekly inflow into equities on record. While a market rebound is likely, the key question remains whether the rally is sustainable or merely a temporary relief bounce before another leg lower.

h/t:

Market Analysis

Keep reading with a 7-day free trial

Subscribe to PalmaFutures Newsletter to keep reading this post and get 7 days of free access to the full post archives.