PLEASE SEE INTRO POST AND READ DISCLAIMER & INTELLECTUAL PROPERTY SECTIONS

NOTE: Free subscribers will continue to receive the weekly Sunday Post, but it will not include the final section with the chart, key levels, and detailed analysis for the upcoming week. Upgrade to a paid subscription to unlock the full Sunday Post and gain exclusive access to subscriber-only daily game plans.

Despite a shortened trading week for the Easter holiday, all major large‑cap benchmarks finished in the red, while small‑caps bucked the trend. The S&P 500 slid about 1.5%, the Dow Jones dropped roughly 2.7%, and the Nasdaq fell around 2.6%, marking the third weekly decline in four for the big three indices. In contrast, the Russell 2000 small‑cap index gained 1.1%, its second positive week out of four. Sector leadership was unusually defensive: eight of eleven S&P 500 groups rose, led by energy and consumer staples.

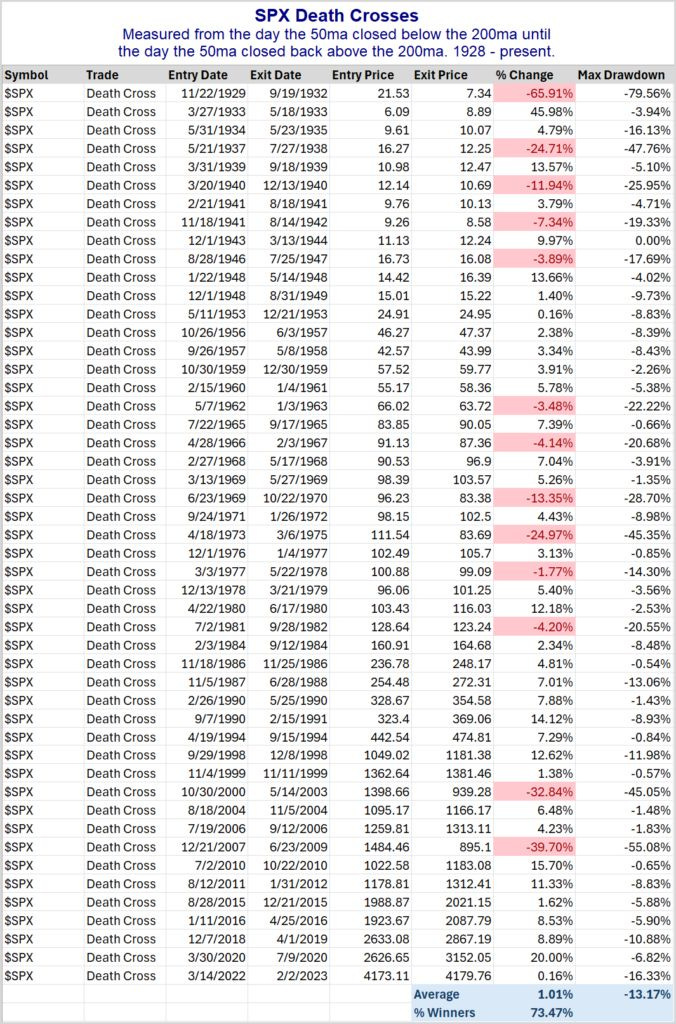

As noted, the daily 50 MA has now crossed below the 200 MA for all major US indexes—a technical pattern commonly referred to as a “death cross.” This is typically considered a Bearish signal. However, like any indicator, it’s far from infallible. In fact, 36 out of 49 historical instances since 1928 (approximately 73.5%) saw the S&P 500 post gains while the death cross was in effect. As the data in the table below illustrates, the challenge lies in the magnitude of the losing trades. Even among the eventual winners, many experienced a significant drawdown before ultimately recovering and posting gains—such as the most recent case in 2022.

h/t:

The ES market remains within the downward channel that originated from the February high, as shown in the daily chart below. After rebounding off the channel support last week, price action is now consolidating near the upper boundary of the channel. Notably, this channel resistance aligns with the March lows, marking a significant area of overhead resistance. A breakout above this area would represent a constructive and potentially Bullish first step in reversing the recent downtrend.

As usual, I will do a brief recap of this week´s market action, followed by an analysis of the general markets and the various sectors, and conclude with an outlook for the upcoming week.

Recap:

The ES market gapped higher at the open during the OVN session to start the shortened holiday week. It initially pushed toward the top of the now 6-Day Balance area, but in the following sessions, it pulled back toward the center of that range. The market then consolidated around this midpoint, ending the week with a lackluster session. Overall, the ES remains rangebound and will need to resolve this Balance area before establishing a clearer short-term directional bias.

General Markets and Sectors:

Check out the updated Charts Page which goes with this section.

The S&P 500 is currently consolidating between the 5451 resistance and the 5188 support within a downward channel There is strong overhead resistance around 5500.

The NDX/Nasdaq initially moved higher toward the downward channel resistance from the February high and then sold off. For now, it is consolidating between the channel resistance and the 18000 support.

The Dow Jones initially moved higher to last week´s high which got rejected. This resulted in a selloff to the 38909 support, near the upward channel support from the March 2020 low. It remains in a downward channel from mid-February.

Small Caps (IWM) is currently consolidating between the 189-resistance level and the 179 support, within the downward channel from the November 2024 high.

The FFTY index back-tested the upward channel from the October 2023 low and consolidated in this area. Let´s see if this market can move back inside the channel or get rejected and sell off again. Note the daily 50 MA about to cross below the 200 MA.

The $VIX continued to fall and is now below the 30 level, meaning not anymore in extreme volatility territory. However, this could change really quickly.

Crude Oil moved higher and is approaching the important resistance at $67. Support is now at $58. It is trading inside the downward channel from the March 2022 high.

Gold made another all-time record high yet again and is very Bullish. It´s the sixth positive week out of the past seven.

The US 10-Year yield broke below the 4.40% support (now resistance) and sold off toward the 4.21% support/daily 200 MA. It is currently at the 50 MA. It remains in the downward channel from the October 2023 high.

The USDJPY is consolidating right above the 141.75 support, which is near the September 2024 lows. Last week, it broke below the upward channel support from the January 2021 low.

Bitcoin continues to consolidate between the 76560 support and the 87300 resistance. It remains within the upward channel from the October 2023 low and is currently trading above the daily 50 MA.

Semis, SOX consolidated near the lower boundary of the downward channel from the July 2024 high.

Consumer Disc, XLY consolidated around the upward channel support from the December 2022 low and remains in a downward channel from the January high. Note the daily 50 MA about to cross below the 200 MA.

The Retail sector, XRT continues to consolidate near the downward channel support from the December 2024 high.

The Tech sector, XLK initially moved higher to the downward channel resistance from the February high but got rejected and sold off.

Transports, IYT continues to consolidate around the upward channel support from the October 2022 low.

Financials sector, XLF is consolidating right below the daily 200 MA and the December 2024 low is holding as support.

The Materials sector, XLB is consolidating around the February 2024 low.

Industrials, XLI is consolidating around the May 2024 highs, which is an important area to watch.

The Health sector, XLV continues to consolidate within the downward channel from the September 2024 high.

Consumer Staples, XLP is currently consolidating around the daily 200 MA/50 MA and within the upward channel from the October 2023 low.

Utilities, XLU is currently consolidating around the daily 200 MA/50 MA and the upward channel support from the October 2023 low.

The Energy sector, XLE has been rangebound for over two years (shaded area) and is currently consolidating near the lower boundary of this range.

YEAR-TO-DATE RETURN:

DJIA Dow Jones -7.6%

SPX S&P 500 -9.8%

IXIC Nasdaq -15.5%

XLP U.S. Consumer Staples Sector: +4.7%

XLU U.S. Utilities Sector: +3.5%

XLV U.S. Health Care Sector: -1.1%

XLF U.S. Financial Sector: -3.1%

XLB U.S. Materials Sector: -3.6%

XLE U.S. Energy Sector: -4.1%

XLI U.S. Industrials Sector: -4.6%

IYT Dow Jones Transports: -11.4%

XRT U.S. Retail Industry: -16.2%

XLK U.S. Technology Sector: -16.9%

XLY U.S. Consumer Disc Sector: -17.1%

SOX Semiconductor Index: -23.7%

Week of 4/21/2025:

Click link for complete Economic Calendar.

United States - earnings reports from Alphabet, Tesla, Boeing, Intel, IBM, Merck, and P&G. Also, durable goods orders and existing home sales.

Europe - earnings reports from SAP, BNP Paribas, AON, and Sanofi.

Flash PMI readings - USA, the Euro Area, Japan, India, and Australia.

Key confidence gauges - Germany, France and the UK.

China - PBoC is set to hold loan prime rates.

Keep reading with a 7-day free trial

Subscribe to PalmaFutures Newsletter to keep reading this post and get 7 days of free access to the full post archives.