NOTE: Free subscribers will continue to receive the weekly Sunday Post, but it will not include the final section with the chart, key levels, and detailed analysis for the upcoming week. Upgrade to a paid subscription to unlock the full Sunday Post and gain exclusive access to subscriber-only daily game plans.

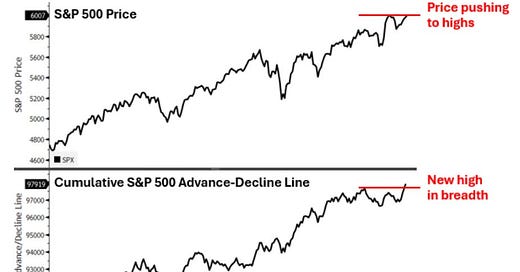

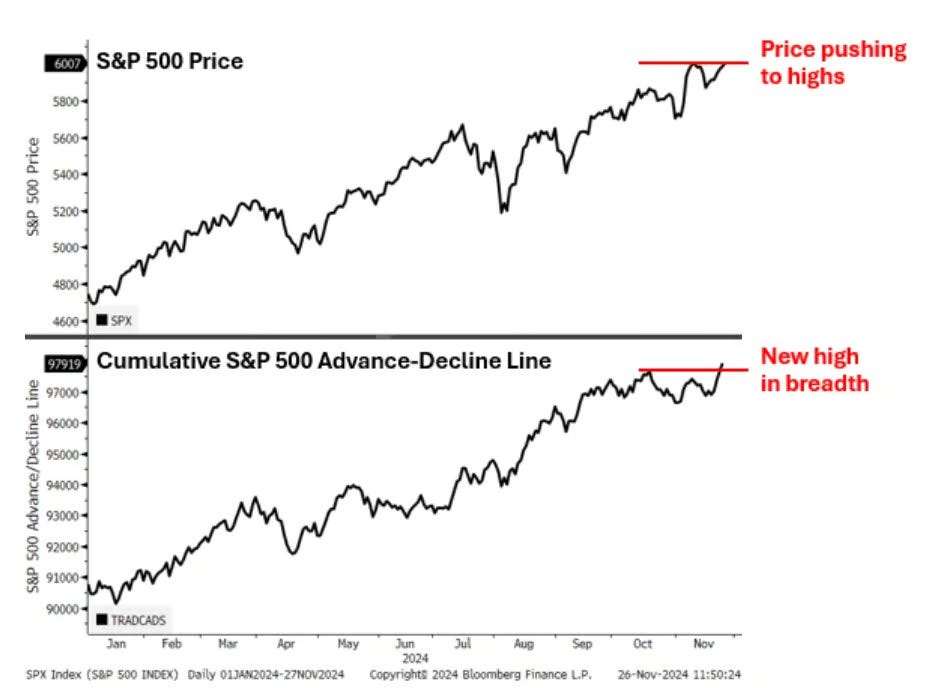

In a holiday-shortened trading week, US equity markets maintained their upward trajectory, each of the major indices adding more than 1%. Both the S&P 500 and the Dow Jones closed at new all-time record highs, reflecting continued investor optimism, while the Nasdaq was slightly below its all-time high. November marked another strong month for US. equities, with all three major indices posting substantial gains. This was the sixth positive month out of the last seven, signaling robust market momentum: The S&P 500 rose 5.7%, the Dow Jones added about 7.5% and the Nasdaq gained about 6.2% for the month. The stock market continues to exhibit strong Bullish momentum which is supported by market breadth as shown in the chart below.

h/t:

The ES market also made a new all-time record high and is gradually approaching the upward channel resistance originating from the October 2023 low (indicated by the blue dashed lines). As illustrated in the daily chart below, this resistance zone is near the 6100 level, and there is a strong likelihood that the market may face rejection at this point.

As usual, I will do a brief recap of this week´s market action, followed by an analysis of the general markets and the various sectors, and conclude with an outlook for the upcoming week.

Recap:

During the holiday-shortened week, the ES market successfully remained within the prior 4-Day Balance range established from early to mid-November. This consolidation further demonstrated the market's strength, ultimately leading to a new all-time record high. The early dip in the week was swiftly defended, preventing the market from fully traversing the prior week’s range. On Friday, the market made a new all-time high of 6060.

General Markets and Sectors:

Check out the updated Charts Page which goes with this section.

The S&P 500 broke above the 6009 resistance (now support) and reached an all-time record high.

The NDX/Nasdaq consolidated above the 20675 support. Nest resistance is at 21171/all-time highs and the market is approaching the upward channel resistance from the January 2023 low.

The Dow Jones broke above the 44359 resistance (now support) and made a new all-time record high.

Small Caps (IWM) gapped up breaking above the 243 resistance and making an all-time record high. However, the market sold off and consolidated below the 243 resistance.

The FFTY index broke above the August 2022 highs and then consolidated.

The $VIX sold off and broke below the recent lows. It remains Bearish for now.

Crude Oil failed to hold above the daily 50 MA and sold off breaking below the long-term support line once again. It is approaching the $67 support one more time which has been holding strongly as support since September. If this area fails, next support is at $58. If this market rebounds, then next resistance is at $73, which aligns with the downward channel resistance from the March 2022 high.

Gold sold off from the 2720 resistance and broke below the 2672 support/daily 50 MA (now resistance). It moved to the 2605 support and slightly bounced back higher.

The US 10-Year yield sold off breaking below the 4.40% support (now resistance) and moving to the 4.21% support/daily 200 MA/50 MA. It has now moved back inside the downward channel from the October 2023 high.

The USDJPY sold off and broke below the daily 200 MA/152 support (now resistance), as well as the 50 MA/the 150 support (now resistance). Next support is at 148.50.

Bitcoin sold off and back-tested the upward channel that was broken the previous week. The 94375-support held as well and if the rally resumes, next resistance is around 105,000.

Semis, SOX has been rangebound since August and consolidated below the daily 200 MA It remains in an upward channel from the October 2022 low.

Consumer Disc, XLY reached a new all-time record high.

The Retail sector, XRT gapped up higher and moved to the February 2022 highs. It remains in an upward channel from the November 2023 low.

The Tech sector, XLK has been consolidating above the daily 50 MA and is close to the all-time record high. It remains in the upward channel from the January 2023 low.

Transports, IYT gapped up to a new all-time record high.

Financials sector, XLF made another all-time record high. It remains in the upward channel from the October 2023 low.

The Materials sector, XLB consolidated around the daily 50 MA. It remains in the upward channel from the October 2022 low.

Industrials, XLI made an all-time record high and then consolidated.

The Health sector, XLV continued to move higher after moving down to the May lows, which is a strong support area. It is now at the daily 200 MA, which could get rejected.

Consumer Staples, XLP continued to rally after moving back inside the steeper upward channel (blue line). It is approaching the all-time highs.

Utilities, XLU moved higher to the long-term upward channel resistance and reached a new all-time record high.

The Energy sector, XLE sold off from the April highs. Note that the daily 50 MA has now crossed above the 200 MA.

YEAR-TO-DATE RETURN:

SPX S&P 500 +28.1%

IXIC Nasdaq +28.9%

DJIA Dow Jones +21.2%

XLF U.S. Financial Sector: +38.1%

XLU U.S. Utilities Sector: +34.0%

XLI U.S. Industrials Sector: +27.6%

XLY U.S. Consumer Disc Sector: +25.1%

XLK U.S. Technology Sector: +22.1%

SOX Semiconductor Index: +20.1%

XLP U.S. Consumer Staples Sector: +17.9%

XLE U.S. Energy Sector: +16.7%

XRT U.S. Retail Industry: +15.5%

IYT Dow Jones Transports: +14.8%

XLB U.S. Materials Sector: +12.2%

XLV U.S. Health Care Sector: +9.3%

Week of 12/2/2024:

Click link for complete Economic Calendar.

United States - JOLT’s job openings, ISM Manufacturing and Services PMI data, Michigan Consumer Sentiment Index, factory orders, and foreign trade figures, and November jobs report. Also, speeches from Federal Reserve officials, including Chair Powell.

Q3 GDP growth rates - South Africa, Brazil and Australia.

Unemployment Rates - Euro Area and Canada.

Manufacturing PMI reports - South Korea, China, Spain, Italy, Canada, and Switzerland.

Services PMI data - China, Italy and Brazil.

Germany - factory orders and industrial production.

India - interest rate decision.

Inflation rates - South Korea, Indonesia, Turkey, Switzerland, and the Philippines.

Keep reading with a 7-day free trial

Subscribe to PalmaFutures Newsletter to keep reading this post and get 7 days of free access to the full post archives.