PLEASE SEE INTRO POST AND READ DISCLAIMER & INTELLECTUAL PROPERTY SECTIONS

Big Picture: Bias is Bearish, Market Has Broken Downward Channel Resistance From February 2025 High, $VIX 25-30 (medium volatility)

Today´s Pivot is 5531

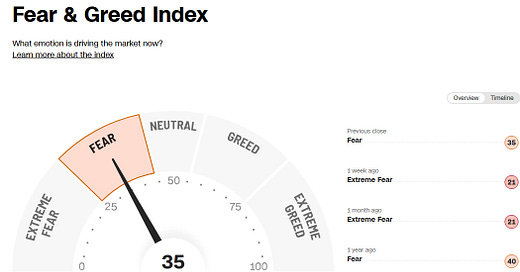

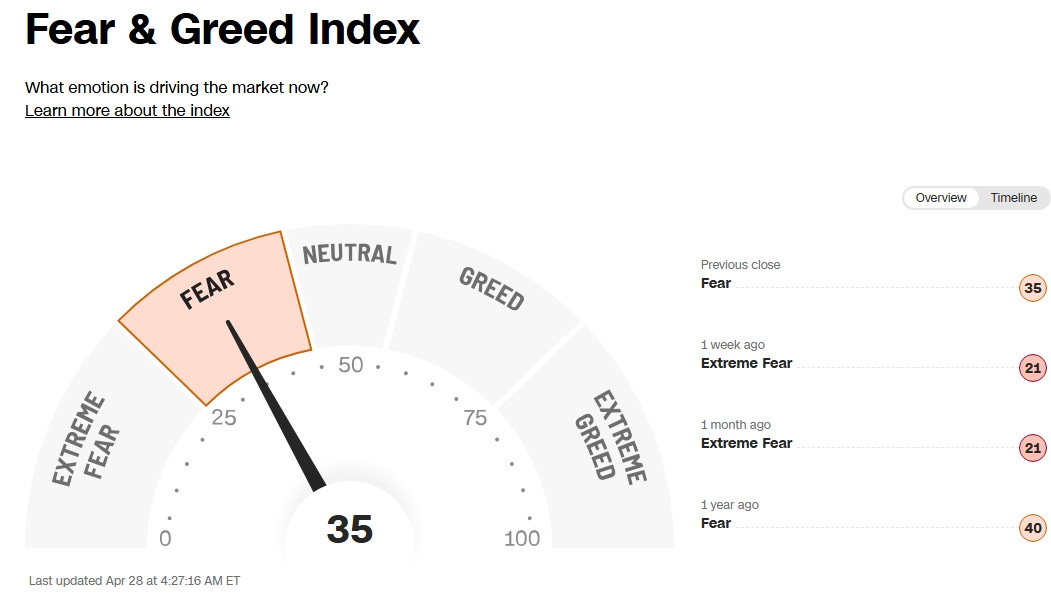

The S&P 500 has rallied sharply from its recent lows and has broken out of the downward channel. As highlighted in the Sunday Post analysis, it is now encountering key overhead resistance, while market sentiment remains deeply negative for the time being. The Fear & Greed Index, currently at 35 (see image below), shows some improvement but continues to reflect a sentiment of fear among investors, signaling cautious behavior in the US stock market. So, can the market continue to climb the wall of worry? Despite persistent fears, markets have historically advanced amid skepticism — and so far, resilience remains the dominant theme.

Last week, both the Bearish and Bullish weekly scenarios unfolded as anticipated, with most targets for each being successfully achieved. The market topped precisely at the second-to-last upside target outlined in the previous Sunday Post analysis. Don't miss the next move — become a Paid Subscriber now for precise, actionable trade plans:

Market Analysis

Keep reading with a 7-day free trial

Subscribe to PalmaFutures Newsletter to keep reading this post and get 7 days of free access to the full post archives.