PLEASE SEE INTRO POST AND READ DISCLAIMER & INTELLECTUAL PROPERTY SECTIONS

NOTE: Free subscribers will continue to receive the weekly Sunday Post, but it will not include the final section with the chart, key levels, and detailed analysis for the upcoming week. Upgrade to a paid subscription to unlock the full Sunday Post and gain exclusive access to subscriber-only daily game plans.

For the week, US stock benchmarks delivered a powerful, broad‐based rally: the Nasdaq surged 6.7%, the S&P 500 climbed 4.6%, and the Dow Jones rose 2.5%. Technology shares led the advance, with AI-linked and large-cap growth names powering the Nasdaq higher as investors cheered strong quarterly results from megacaps. Small-caps also participated meaningfully, with the Russell 2000 adding over 4%, highlighting the breadth of the week’s rally. Meanwhile, prices of US government bonds rose, sending yields lower, amid an easing of recent volatility across the fixed-income markets.

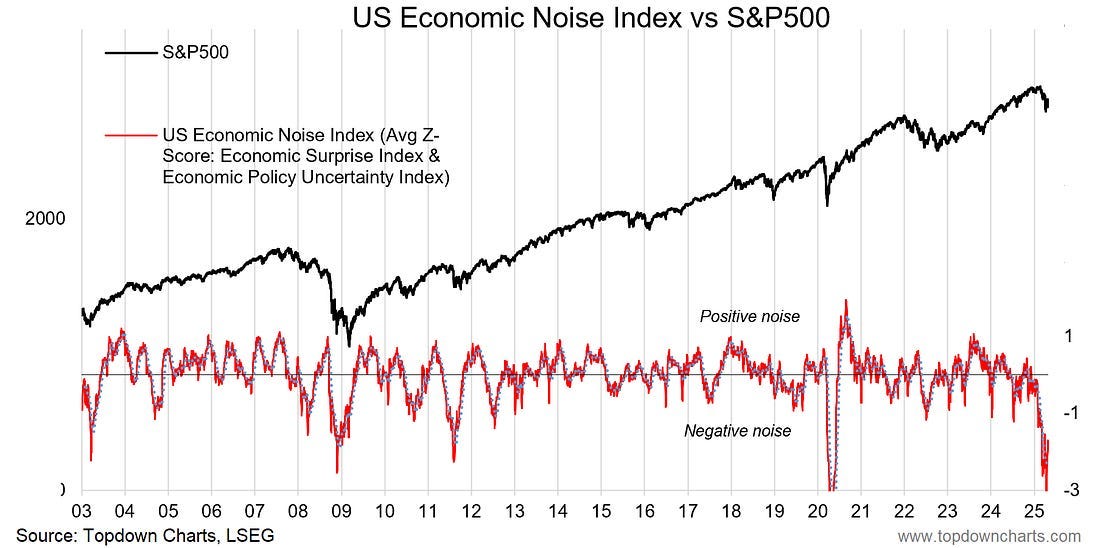

The S&P 500 has rallied 14% off its low but remains about 10% below its February 19 high. It is now approaching a declining daily 50 MA and encountering overhead resistance near the July/August 2024 highs. Despite the strength of this rally, the Economic Noise Index remains deeply negative for now. See the chart below. Once again, this is yet another indicator that has reached levels historically associated with prior market bottoms.

h/t:

The ES market gapped higher and later broke above the downward channel resistance stemming from the February high, as illustrated in the daily chart below. It has approached the March lows, a key resistance zone, and is also facing a declining daily 50 MA. The question remains whether this whole area will act as resistance and trigger some sort of a selloff, or if the market will continue to rally higher.

As usual, I will do a brief recap of this week´s market action, followed by an analysis of the general markets and the various sectors, and conclude with an outlook for the upcoming week.

Recap:

The ES market opened with a downside gap during the Sunday evening OVN session to start the week. The market sold off, reaching the bottom of the 10-Day Balance area, and briefly broke below it. Most of the downside targets outlined in the prior Sunday Post analysis were achieved, with the market finding support right at the third-to-last target. However, the break below the Balance was short-lived, as the market staged a rally Monday afternoon, closing back inside the Balance area. The rally continued the following day, and the weekly Pivot was reclaimed with a gap-up — a key requirement for upside continuation. After a successful back-test of the weekly Pivot, the market rallied to the top of the Balance area by Thursday. On Friday, the market initially broke above the Balance but faced rejection; however, it ultimately managed to close above the top of the Balance, achieving the second-to-last upside target for the week. As outlined in the prior Sunday Post analysis, both the Bearish and Bullish scenarios played out as anticipated.

General Markets and Sectors:

Check out the updated Charts Page which goes with this section.

The S&P 500 found support at the 5111 level and then rallied higher, breaking above the downward channel from the February high. There are strong overhead resistances around the 5550 zone and declining daily 50 MA.

The NDX/Nasdaq made a higher low and then broke the downward channel resistance from the February high. It has now approached the 19470 resistance and the declining daily 50 MA.

The Dow Jones initially sold off and broke below the upward channel support from the March 2020 low, finding support at the 37715 level. However, this market staged a rally reclaiming the channel support and moving higher to the 40000 level. It remains in the downward channel from mid-February and also faces overhead resistances at the 41198 level and declining daily 50 MA.

Small Caps (IWM) broke above the 189-resistance level (now support) and remains in the downward channel from the November 2024 high. Strong resistances at the 200 level and declining daily 50 MA.

The FFTY index initially sold off and then moved higher to back-test the upward channel from the October 2023 low once again. Let´s see if this market can move back inside the channel or get rejected and sell off again. Note the daily 50 MA has crossed below the 200 MA.

The $VIX sold off further down moving below 25 and has become Bearish now.

Crude Oil is currently consolidating and faces overhead resistances at the $67 level, daily 50 MA and the downward channel resistance from the March 2022 high. Support is at $58.

Gold made another all-time record high yet again but then sold off sharply to the 3288 support. Next resistance is at 3424 and next support is a 3138.

The US 10-Year yield is currently consolidating between the 4.40% resistance and the 4.21% support/daily 200 MA. It remains in the downward channel from the October 2023 high.

The USDJPY initially sold off to the September 2024 low and then rallied higher reclaiming the 141.75 support. It remains in a downtrend.

Bitcoin rallied sharply higher moving back above the daily 200 MA and broke above the 92500 resistance. It remains within the upward channel from the October 2023 low.

Semis, SOX rallied higher and is approaching the declining daily 50 MA. It remains in the downward channel from the July 2024 high.

Consumer Disc, XLY initially sold off below the upward channel support from the December 2022 low and then rallied higher moving back inside this channel. It also broke above the downward channel resistance from the January high. Note the daily 50 MA has crossed below the 200 MA.

The Retail sector, XRT moved higher to the 70.60 resistance level and the daily 50 MA but was quickly rejected. It remains in the downward channel from the December 2024 high.

The Tech sector, XLK gapped up and then broke the downward channel resistance from the February high. It is approaching the declining daily 50 MA.

Transports, IYT continues to consolidate around the upward channel support from the October 2022 low.

Financials sector, XLF moved back above the daily 200 MA and hit the downtrend line/daily 50 MA but got rejected.

The Materials sector, XLB moved higher towards the declining daily 50 MA. It remains in the downward channel from the October 2024 high.

Industrials, XLI gapped up and moved higher toward the declining daily 50 MA. Although it is in a downtrend, it remains in the upward channel from the March 2020 lows.

The Health sector, XLV continues to consolidate within the downward channel from the September 2024 high.

Consumer Staples, XLP continues to consolidate around the daily 200 MA/50 MA and is within the upward channel from the October 2023 low.

Utilities, XLU initially broke the upward channel support from the October 2023 low and then rallied higher moving back inside the channel. It is consolidating around the daily 200 MA/50 MA.

The Energy sector, XLE has been rangebound for over two years (shaded area) and is currently consolidating near the lower boundary of this range.

YEAR-TO-DATE RETURN:

DJIA Dow Jones -5.2%

SPX S&P 500 -5.7%

IXIC Nasdaq -9.8%

XLU U.S. Utilities Sector: +4.1%

XLP U.S. Consumer Staples Sector: +3.4%

XLV U.S. Health Care Sector: +0.7%

XLF U.S. Financial Sector: -0.3%

XLB U.S. Materials Sector: -1.3%

XLI U.S. Industrials Sector: -1.8%

XLE U.S. Energy Sector: -3.1%

XLK U.S. Technology Sector: -10.2%

IYT Dow Jones Transports: -11.2%

XLY U.S. Consumer Disc Sector: -11.7%

XRT U.S. Retail Industry: -13.7%

SOX Semiconductor Index: -15.4%

Week of 4/28/2025:

Click link for complete Economic Calendar.

United States - first estimate of Q1 2025 GDP growth, jobs report, PCE inflation data, and the ISM Manufacturing PMI. Earnings season will also take center stage, with major companies such as Apple, Microsoft, Amazon, Meta.

Eurozone - flash GDP and inflation figures.

Bank of Japan - interest rate decision.

China - April PMI readings.

Australia - inflation data.

Keep reading with a 7-day free trial

Subscribe to PalmaFutures Newsletter to keep reading this post and get 7 days of free access to the full post archives.