PLEASE SEE INTRO POST AND READ DISCLAIMER & INTELLECTUAL PROPERTY SECTIONS

Big Picture: Bias is Bullish, Market In Upward Channel From April 2025 Lows, $VIX 20-25 (Mild Volatility)

Today´s Pivot is 5815

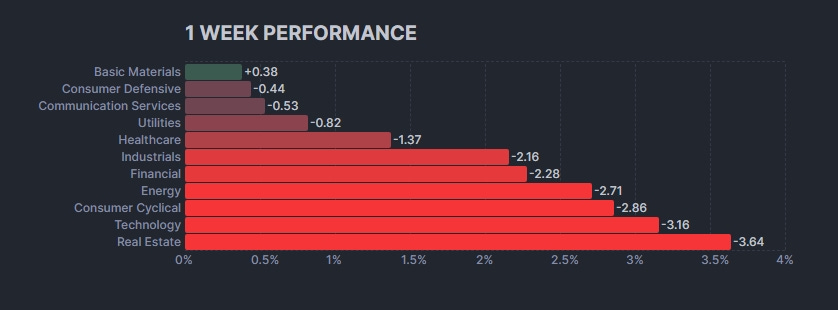

As summarized in the Sunday Post, equities and most sectors sold off last week, driving demand for safe-haven assets. Only Basic Materials eked out a gain, while the rest of the market retreated. Traditional defensives—Consumer Staples, Communication Services, Utilities and Healthcare—were the “least bad,” underscoring investors’ flight to relative safety amid choppy trading. Cyclical sectors took the brunt of the downturn: Industrials, Financials and Energy each fell more than 2%, pressured by modest crude-oil weakness and bond-yield volatility. The steepest losses hit growth- and rate-sensitive areas—Consumer Discretionary, Technology and Real Estate—as they absorbed the bulk of last week’s repositioning. In sum, this pullback reflects a broader shift toward quality and yield stability, with outsize pain in the most economically sensitive corners of the market. Going forward, investors will be watching closely to see whether this defensive rotation persists.

Last week, the Bearish weekly scenario unfolded as anticipated, with all targets being successfully achieved. The market broke through the key support area, fulfilling the downside condition outlined in the previous Sunday Post analysis. Don't miss the next move — become a Paid Subscriber now for precise, actionable trade plans:

Market Analysis

Keep reading with a 7-day free trial

Subscribe to PalmaFutures Newsletter to keep reading this post and get 7 days of free access to the full post archives.