PLEASE SEE INTRO POST AND READ DISCLAIMER & INTELLECTUAL PROPERTY SECTIONS

Big Picture: Bias is Bearish, Market Has Broken Downward Channel Resistance From February 2025 High, $VIX 20-25 (Mild Volatility)

Today´s Pivot is 5678

In the Sunday Post, I outlined how I’ve been providing valuable insights to readers about a potential market bottom or reversal since late March. The market has now broken out of its downward channel and closed above the daily 50 MA, as shown in the daily ES chart featured in that post. So, what’s next?

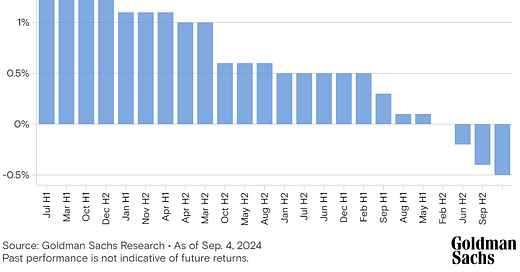

The chart below highlights seasonal patterns in the S&P 500, showing that the first half of May has historically been one of the weaker periods for the index. Since 1950, this early-May softness has often been followed by stronger performance in the second half of the month. Of course, nothing is ever certain in markets. That’s why the PalmaFutures Newsletter remains focused on price action and level-to-level trading—my core approach, no matter the season.

Last week, the Bullish weekly scenario unfolded as anticipated, with most targets being successfully achieved. The market topped precisely at the second-to-last upside target outlined in the previous Sunday Post analysis. Don't miss the next move — become a Paid Subscriber now for precise, actionable trade plans:

Market Analysis

Keep reading with a 7-day free trial

Subscribe to PalmaFutures Newsletter to keep reading this post and get 7 days of free access to the full post archives.