PLEASE SEE INTRO POST AND READ DISCLAIMER & INTELLECTUAL PROPERTY SECTIONS

NOTE: Free subscribers will continue to receive the weekly Sunday Post, but it will not include the final section with the chart, key levels, and detailed analysis for the upcoming week. Upgrade to a paid subscription to unlock the full Sunday Post and gain exclusive access to subscriber-only daily game plans.

The US stock market was strong this week, as investors cheered easing geopolitical tensions, progress in trade talks, and growing Fed rate-cut expectations. The S&P 500 rose 3.4%, closing at a record 6,173.07; the Nasdaq rose 4.2%, also marking a record high at 20,273.46; the Dow Jones gained 3.8%, closing around 43,819.27 (still ~ 2.7% below its all-time high); and the Russell 2000 rose 3.0%, finishing near 2,172.5. Energy was the only sector that declined significantly, falling about –3.5%; Communications Services and Information Technology led gains, followed by Industrials, Financials, and Consumer Discretionary. Market breadth improved—advance/decline lines on both the NYSE and Nasdaq rose, and nine of eleven S&P sectors participated in the rally. Volatility declined, with the VIX falling to 16.3 from 20.6. AAII Bullish sentiment edged higher to 35.1%, while the CNN Fear & Greed Index moved into Greed territory at 65.

Bond yields drifted lower amid rate-cut optimism: The 10‑Year Treasury yield dropped to 4.275%, and the 30‑Year yield declined to 4.832%. Gold declined 2.8%, ending the week around $3,273/oz. WTI Crude Oil slid roughly 12% on the week, ending near $65.07/barrel. Bitcoin (BTC) moved from ~$100,000 at week's start to a mid-week high of $108,358, closing around ~$108,076. US-listed spot Bitcoin ETFs saw continued inflows, with BlackRock’s IBIT and Fidelity’s FBTC drawing approximately $228 m in net inflows mid-week, supporting the rally.

Overall, this week’s narrative was a broad-based risk-on surge: all major indices rallied, mega-cap Tech and Communication Services outperformed, Energy lagged, breadth improved across nine sectors, volatility eased, bond yields dropped, gold slid, oil fell sharply, and crypto climbed on ETF flows. Sentiment shifted into greed, underpinned by dovish Fed views and geopolitical calm.

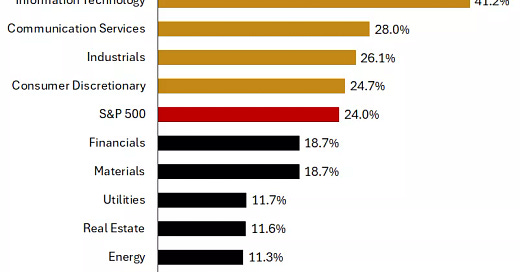

The S&P 500 has gained approximately 24% since the April 8 lows, with growth-oriented sectors such as Technology, Communication Services, and Consumer Discretionary outperforming—some by a wide margin. The chart below illustrates the performance of the S&P 500 and its GICS sectors from April 8 through June 27. Gains have been strongest in the growth segments of the market, particularly Technology and Communication Services, while defensive sectors like Consumer Staples and Health Care have lagged behind.

h/t: FactSet

Here´s an interesting chart that shows investing at all-time highs often leads to stronger forward returns compared to investing at random days. Key takeaways:

Over short time frames (3 to 12 months), returns are slightly lower when investing at a new high versus any day.

Over longer time frames (2 to 5 years), investing at a new high actually outperforms, with a 5-year return of 80.9% vs. 74.7% when investing on any day.

This challenges the common fear of “buying at the top,” suggesting that investing at new highs historically leads to strong long-term returns.

h/t: IsabelNet

With the daily 200 MA holding as support, the ES market finally broke out of its multi-day Balance range and rallied higher. It is now approaching the all-time high and remains within the broader upward channel that began at the April lows.

As usual, I will do a brief recap of this week´s market action, followed by an analysis of the general markets and the various sectors, and conclude with an outlook for the upcoming week.

Recap:

The ES market opened the week with a sharp gap down, marking a clear breakdown of the multi-day Balance range. It then tested the daily 200 MA and rebounded sharply, moving back inside the Balance area. This was a textbook example of a failed breakdown—a setup I frequently highlight in the Newsletter, as it often presents high-probability counter-trade opportunities. Following the rebound, the market reclaimed both the weekly Pivot of 6032 and the daily 20 MA—key conditions for the Bullish scenario outlined in the previous Sunday Post. The rally continued, reaching the top of the 12-Day Balance, which was broken in the OVN session on Tuesday. From there, the market moved decisively higher, achieving and surpassing all upside targets for the week. The ES is now in a Bullish Imbalance phase and has approached its all-time high.

General Markets and Sectors:

Check out the updated Charts Page which goes with this section.

The S&P 500 rallied higher breaking above the 6090 resistance (now support) and making a new all-time record high.

The NDX/Nasdaq rallied higher breaking above the 22100 resistance (now support) and making a new all-time high. It remains inside the upward channel from the December 2022/January 2023 lows.

The Dow Jones reclaimed the daily 200 MA and rallied higher to the 43730 resistance. Support is at 43276 and next resistance is at 44359.

Small Caps (IWM) reclaimed the 212 level (now support) and moved slightly above the daily 200 MA. Must hold this area for higher prices.

The FFTY index moved higher after being in consolidation and remains inside the upward channel from the October 2023 low. Note that the daily 50 MA has crossed above the 200 MA.

The $VIX sold off to the recent lows and remains technically weak which reflects a generally Bullish environment for equities.

Crude Oil got rejected at the $77 resistance and sold off sharply, breaking below the daily 200 MA and the $67 support (now resistances). For now, it is holding above the 50 MA.

Gold sold off breaking below the daily 50 MA and the 3288 support. It is now back-testing the upward channel from February 2024 low. Overall, Gold has been consolidating since April.

The US 10-Year sold off and broke below the daily 200 MA with support at 4.21%. It remains in the downward channel from the October 2023 high.

The USDJPY moved higher and back-tested the upward channel from the January 2021 low. This area was rejected resulting in a selloff to the daily 50 MA and the 145 support.

Bitcoin rallied higher breaking above the daily 50 MA/the 106175 resistance and moving to the upward channel resistance from the October 2023 low. Next resistance is at 110300.

Semis, SOX rallied higher to the January high and is gradually approaching the all-time highs. It remains in the upward channel from the October 2022 low.

Consumer Disc, XLY has been consolidating above the daily 200 MA and seems like it is breaking out of this range. It remains in the upward channel from the December 2022 low.

The Retail sector, XRT continues to consolidate between the 79-resistance level and the 75 support/daily 200 MA.

The Tech sector, XLK rallied higher and made a new all-time record high. It remains in the upward channel from the October 2022 low.

Transports, IYT continues to consolidate between the daily 200 MA and the 50 MA. It remains in the upward channel from the October 2022 low.

Financials sector, XLF moved higher and broke above the long-term resistance line. It is approaching the all-time highs.

The Materials sector, XLB has been rangebound since May, right below the daily 200 MA. It remains within a long-term upward channel.

Industrials, XLI rallied to a new all-time record high. It remains in the upward channel from the March 2020 lows.

The Health sector, XLV has been in a wide-ranged consolidation since April and remains in the downward channel from the September 2024 high.

Consumer Staples, XLP continues to consolidate around the daily 200 MA/50 MA (now below it) and remains within the upward channel from the October 2023 low.

Utilities, XLU continues to consolidate and remains in the upward channel from the October 2023 low.

The Energy sector, XLE sold off sharply breaking back below the daily 200 MA. It has been rangebound for over two years (shaded area).

YEAR-TO-DATE RETURN:

SPX S&P 500 +5.6%

IXIC Nasdaq +5.3%

DJIA Dow Jones +3.9%

XLI U.S. Industrials Sector: +12.1%

SOX Semiconductor Index: +10.3%

XLU U.S. Utilities Sector: +9.0%

XLF U.S. Financial Sector: +8.2%

XLK U.S. Technology Sector: +8.2%

XLB U.S. Materials Sector: +5.5%

XLP U.S. Consumer Staples Sector: +3.7%

IYT Dow Jones Transports: +1.9%

XLE U.S. Energy Sector: +1.2%

XLV U.S. Health Care Sector: -1.8%

XLY U.S. Consumer Disc Sector: -2.1%

XRT U.S. Retail Industry: -2.3%

Week of 6/30/2025:

Click link for complete Economic Calendar.

United States - Jobs report, the ISM Manufacturing & Services PMIs, US exports & imports.

China - official and Caixin PMIs.

Germany - factory orders.

Japan - Tankan business sentiment survey.

Australia - trade figures.

Eurozone - inflation.

Market Analysis

Keep reading with a 7-day free trial

Subscribe to PalmaFutures Newsletter to keep reading this post and get 7 days of free access to the full post archives.