NOTE: Free subscribers will continue to receive the weekly Sunday Post, but it will not include the final section with the chart, key levels, and detailed analysis for the upcoming week. Upgrade to a paid subscription to unlock the full Sunday Post and gain exclusive access to subscriber-only daily game plans.

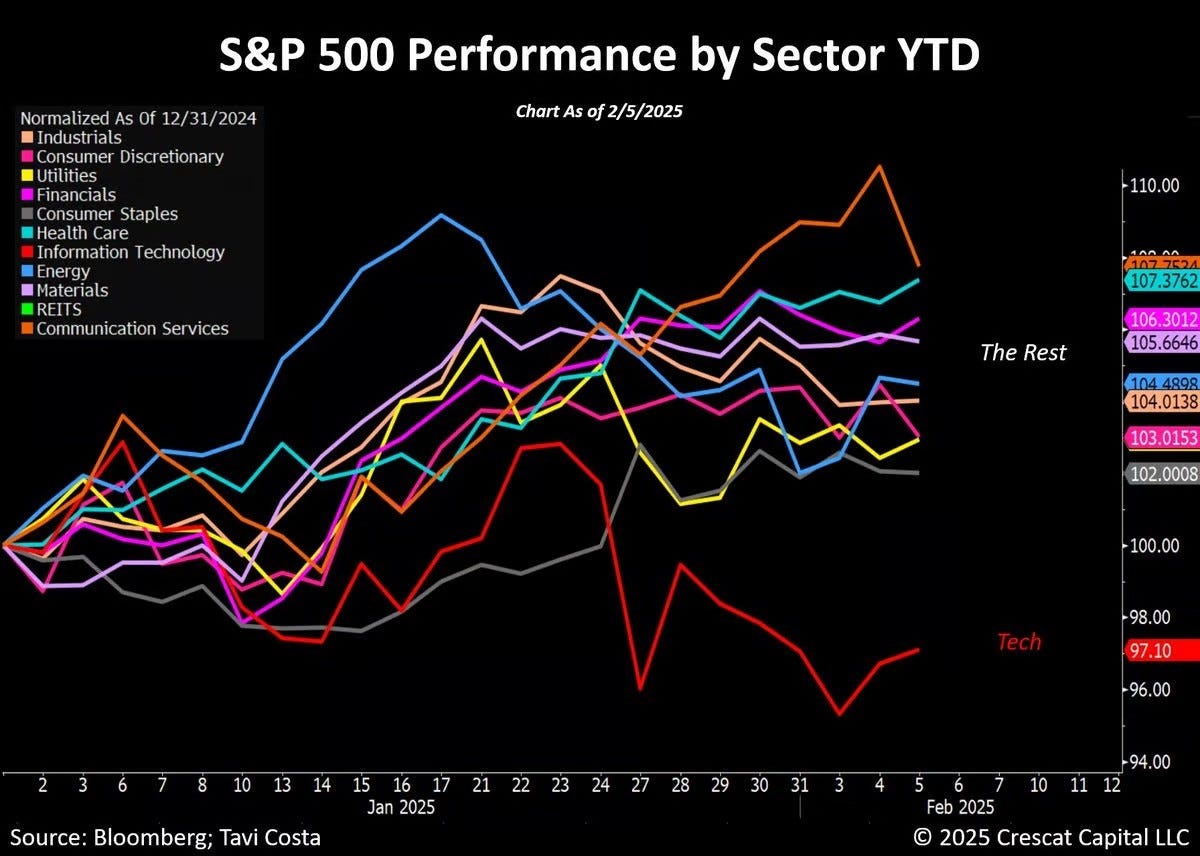

The major US indexes began the week with declines but managed to recover some losses, ultimately closing with fractional decreases. The S&P 500 declined by 0.2%, while the Nasdaq and the Dow Jones fell by 0.5% each. With respect to sectors, there has been significant rotation happening beneath the surface of the markets. Technology is the only sector down year-to-date, while all other sectors have posted gains—some quite substantially already. See chart below:

Just like the previous week, the ES market opened with a gap down and dipped below the daily 50 MA. However, as the week progressed, the market gradually climbed back. As shown in the daily chart below, the market has been trading sideways since early November. The market's choppy performance reflects ongoing investor caution.

As usual, I will do a brief recap of this week´s market action, followed by an analysis of the general markets and the various sectors, and conclude with an outlook for the upcoming week.

Recap:

The ES market gapped down at the start of the week, approaching the lower boundary of the now 16-Day Balance, which was eventually broken. The market sold off to the final downside target for the week, as outlined in the previous Sunday Post analysis. Coincidently, the final downside target happened to be the bottom for the week. However, the market then rallied back inside the Balance, leading to a failed breakdown. After moving toward the center of the Balance area, the market consolidated for a period before pushing higher. By Friday, it neared the top of the Balance, but the Buyers struggled to gain traction, leading to a sudden sell-off to the daily 50 MA.

General Markets and Sectors:

Check out the updated Charts Page which goes with this section.

The S&P 500 gapped down below the daily 50 MA which was then reclaimed resulting in a push back higher to the 6090 resistance. This level was rejected and the market sold off. Support is 6009/daily 50 MA.

The NDX/Nasdaq gapped down below the daily 50 MA but then rallied back higher. Resistance is at 21625 and support is daily 50 MA, then 21171 level. This market has been rangebound since November.

The Dow Jones gapped down toward the daily 50 MA and then rallied back to the 45014 resistance. The market then sold off to the 44359 support. Next supports are the daily 50 MA/43730 level.

Small Caps (IWM) continues to consolidate around the 227 support and the daily 50 MA.

The FFTY index gapped down and broke the upward channel support from the August lows. However, the market rallied and moved back inside the channel to the recent highs. This market has been rangebound since November.

The $VIX gapped up and moved higher to the 20-level but failed to hold resulting in a selloff that filled the gap. For now, it remains Bearish, but this could change very quickly.

Crude Oil was rejected at the daily 200 MA and sold off breaking below the $73 support (now resistance), as well as the daily 50 MA. It is now back-testing the downward channel from the March 2022 high.

Gold made a new all-time record high for the second week in a row. The 2787 level, which aligns with the previous October high, is now support.

The US 10-Year yield sold off from the 4.57% resistance to the 4.40% support, which was defended. This market then moved higher to the daily 50 MA.

The USDJPY sold off from the 155 resistance/daily 50 MA to the 152 support. It has now broken below the daily 200 MA as well. If this area is not reclaimed, could see more downside.

Bitcoin continues to consolidate between the 106175 resistance (near all-time high) and the 92500 support. It is now trading below the daily 50 MA.

Semis, SOX has been rangebound since August and is now back below the daily 200 MA/50 MA. It remains in an upward channel from the October 2022 low.

Consumer Disc, XLY broke below the daily 50 MA and the upward channel support from the August low.

The Retail sector, XRT was rejected at the daily 50 MA and sold off breaking the upward channel support from the November 2023 low. Next support is at the daily 200 MA.

The Tech sector, XLK has been rangebound since November and gapped down to the bottom of this range, which got defended. It remains in the upward channel from the January 2023 low.

Transports, IYT gapped down toward the daily 200 MA but then rallied and moved back above the 50 MA. It remains in the upward channel from the October 2022 low.

Financials sector, XLF moved higher and made another new all-time record high. It remains inside the upward channel from the October 2023 low.

The Materials sector, XLB continues to consolidate around the daily 50 MA and failed to close above this MA.

Industrials, XLI gapped down and then consolidated around the daily 50 MA. It remains in an upward channel from the March 2020 low.

The Health sector, XLV continues to consolidate around the daily 200 MA.

Consumer Staples, XLP continues to consolidate around the daily 200 MA/50 MA.

Utilities, XLU continues to consolidate between the daily 50 MA and the 200 MA. It remains in the upward channel for the October 2023 low.

The Energy sector, XLE consolidated below the daily 200 MA/50 MA after being rejected at the uptrend line from the October 2020 low couple weeks ago. Note that this market has been rangebound for at least two years (shaded area).

YEAR-TO-DATE RETURN:

DJIA Dow Jones +4.2%

SPX S&P 500 +2.6%

IXIC Nasdaq +1.1%

XLF U.S. Financial Sector: +7.2%

XLV U.S. Health Care Sector: +6.4%

IYT Dow Jones Transports: +5.2%

XLB U.S. Materials Sector: +4.9%

XLI U.S. Industrials Sector: +4.2%

XLE U.S. Energy Sector: +3.4%

XLU U.S. Utilities Sector: +3.2%

XLP U.S. Consumer Staples Sector: +0.9%

XLY U.S. Consumer Disc Sector: +0.5%

XLK U.S. Technology Sector: +0.1%

SOX Semiconductor Index: -0.3%

XRT U.S. Retail Industry: -1.7%

Week of 2/10/2025:

Click link for complete Economic Calendar.

United States - CPI report, producer prices, retail sales, and industrial production. Earnings reports from McDonald's, Vertex Pharmaceuticals, Coca-Cola, S&P Global, Gilead Sciences, Cisco Systems, Applied Materials, and Deere & Co. Also, Fed Chair Powell’s testimony before Congress.

China - CPI, PPI and monetary aggregates.

India - inflation rate.

GDP growth figures - UK and Euro Area.

Monetary policy decisions - Russia and the Philippines.

Keep reading with a 7-day free trial

Subscribe to PalmaFutures Newsletter to keep reading this post and get 7 days of free access to the full post archives.