PLEASE SEE INTRO POST AND READ DISCLAIMER & INTELLECTUAL PROPERTY SECTIONS

Big Picture: Bias is Bullish, Market In Upward Channel From April 2025 Lows, $VIX Below 20 (complacency)

Today´s Pivot is 6036

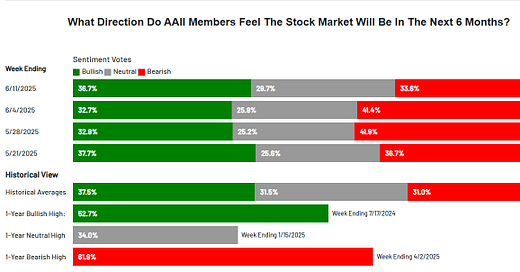

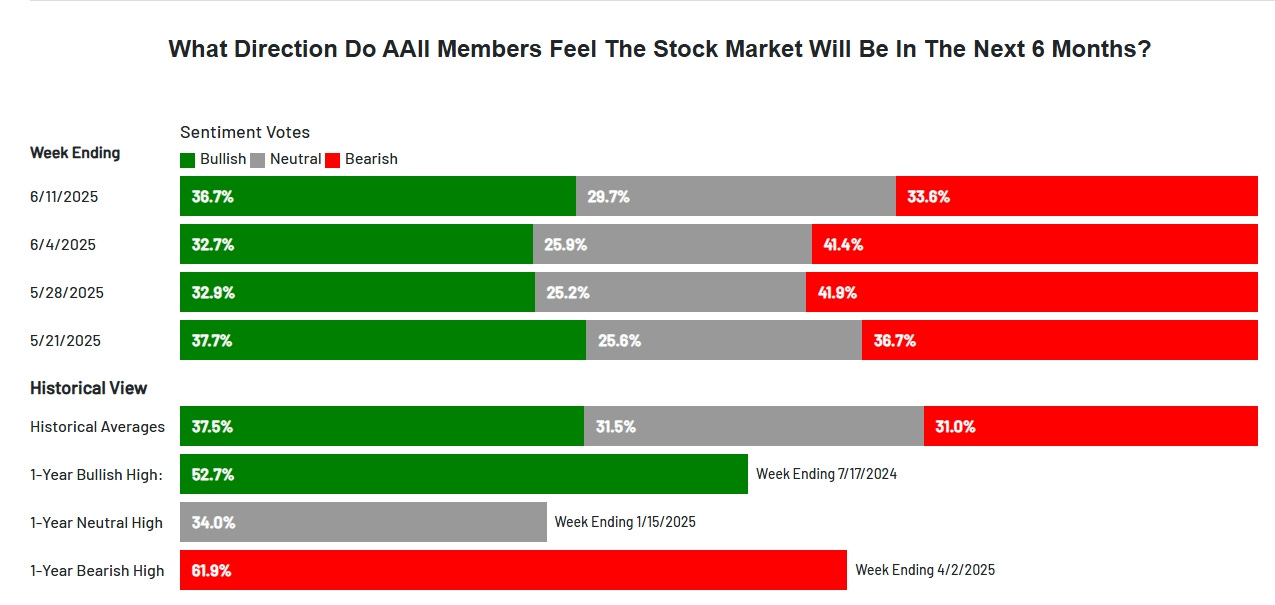

Stock market sentiment is crucial for traders, as it helps anticipate potential turning points—extreme optimism or pessimism can signal overbought or oversold conditions. In the Sunday Post, I shared several charts that highlighted the current state of sentiment, which appears mixed, with investment managers remaining relatively defensive. Notably, the $VIX spiked above the key 20 level and has shown technical strength, reflecting a generally Bearish tone for equities. However, the AAII Bullish Sentiment reading rose slightly last week compared to the previous week, indicating a degree of cautious optimism. See the graph below. Historically, June falls within a weaker summer period that tends to carry a slight negative bias on average, with the first half typically performing better than the second half.

Last week, the top of the prior 18-Day Balance was defended early on—an important condition for the Bullish scenario outlined in the previous Sunday Post. The ES market moved higher through the first half of the week, reaching multiple upside targets. With this kind of insight, both day traders and swing traders had profitable opportunities. Don't miss the next move — become a Paid Subscriber now for precise, actionable trade plans:

Market Analysis

Keep reading with a 7-day free trial

Subscribe to PalmaFutures Newsletter to keep reading this post and get 7 days of free access to the full post archives.