PLEASE SEE INTRO POST AND READ DISCLAIMER & INTELLECTUAL PROPERTY SECTIONS

Big Picture: Bias is Bullish, Market In Upward Channel From April 2025 Lows, $VIX 20-25 (Mild Volatility)

Today´s Pivot is 6019

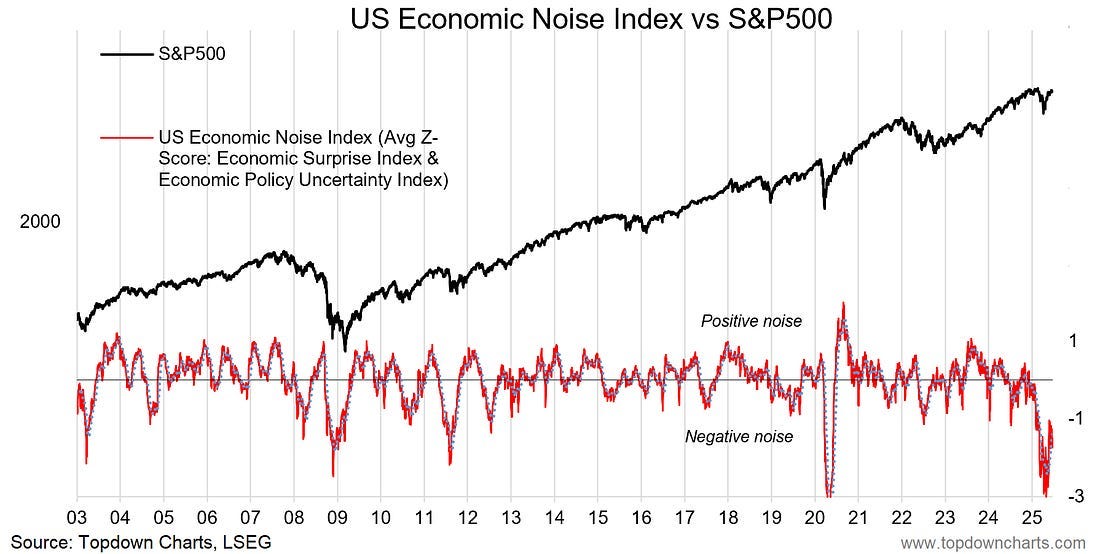

Based on the analysis from the Sunday Post, the major US indexes and most sectors remain in consolidation, signaling broad market indecision and a lack of clear directional momentum. This hesitation is largely driven by the persistently negative Economic Noise Index, which reflects heightened levels of uncertainty and conflicting macro signals facing investors. See the chart below. With volatility still elevated and sentiment fragile, risk management remains essential in this environment. That said, it's worth remembering that equity markets often advance despite uncertainty—frequently "climbing a wall of worry" as they digest and adapt to evolving narratives.

h/t:

Despite an early rally last week, the ES market sold off sharply, hitting many of the downside targets outlined in the Bearish scenario from the previous Sunday Post. This type of timely insight offered profitable opportunities for both day traders and swing traders. Don't miss the next move — become a Paid Subscriber now for precise, actionable trade plans:

Market Analysis

Keep reading with a 7-day free trial

Subscribe to PalmaFutures Newsletter to keep reading this post and get 7 days of free access to the full post archives.