PLEASE SEE INTRO POST AND READ DISCLAIMER & INTELLECTUAL PROPERTY SECTIONS

Big Picture: Bias is Bullish, Market In Upward Channel From April 2025 Lows, $VIX Below 20 (complacency)

Today´s Pivot is 6215

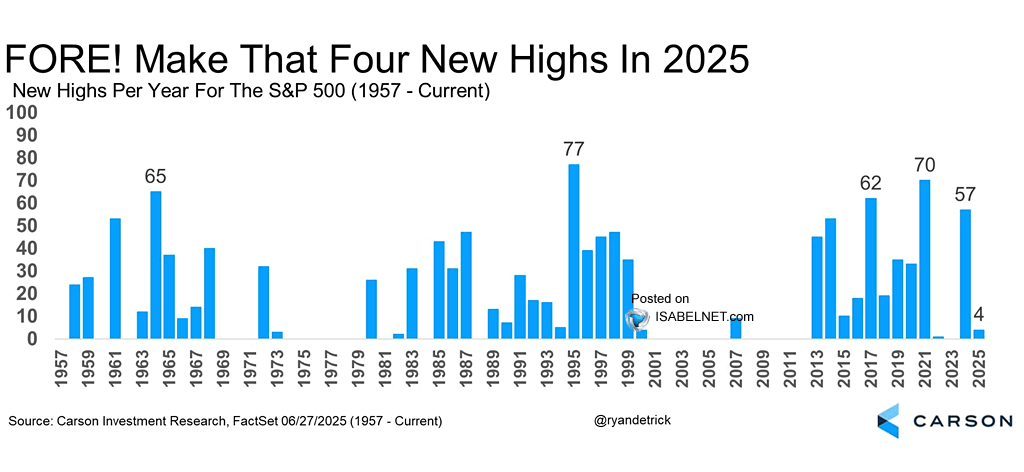

The S&P 500 recently reached another record high, propelled by strong corporate earnings and renewed optimism about the economic outlook. As highlighted in the Sunday Post, history shows that investing at all-time highs often results in superior forward returns compared to entering the market on arbitrary days. The chart below reinforces this point by illustrating that new highs tend to occur in clusters rather than in isolation—suggesting momentum, not exhaustion. Notably, in years like 1964, 1995, and 2017, a surge in new highs marked sustained Bull runs. As of now, 2025 has recorded just four new highs—still modest relative to historical precedent. If the current market rhythm continues, there may be ample room for further upside.

h/t: IsabelNet

After a failed breakdown of the Balance early last week—a setup I frequently spotlight in the Newsletter for its high-probability counter-trade potential—the ES market reclaimed both the weekly Pivot of 6032 and the daily 20 MA. This met the key condition for the Bullish scenario outlined in the previous Sunday Post. From there, price moved decisively higher, reaching and exceeding all upside targets for the week. These types of timely insights continue to deliver actionable opportunities for both day and swing traders. Don't miss the next move — become a Paid Subscriber now for precise, actionable trade plans:

Market Analysis

Keep reading with a 7-day free trial

Subscribe to PalmaFutures Newsletter to keep reading this post and get 7 days of free access to the full post archives.